Safe Investing – A Comprehensive Guide

- Introduction

- Understanding Risk and Return

- Diversification: The Foundation of Safe Investing

- Asset Allocation: Finding the Right Balance

- Asset allocation refers to the strategic distribution of your investment capital across various asset classes based on your risk tolerance, investment horizon, and financial goals. A balanced asset allocation strategy aims to optimize risk-adjusted returns by allocating assets according to their expected risk and return characteristics. Factors to consider when determining asset allocation include age, income, time horizon, and liquidity needs.

- For example, younger investors with a longer time horizon may tilt their portfolios towards equities, which historically offer higher returns over the long term despite greater short-term volatility. On the other hand, older investors approaching retirement may prioritize capital preservation and income generation, leading to a more conservative allocation with a higher proportion of fixed-income investments.

- Risk Management: Setting Realistic Expectations

- Effective risk management is essential for safeguarding your investments against unforeseen market events and downturns. While it’s natural to seek high returns, it’s equally important to temper expectations and avoid taking excessive risks in pursuit of quick gains. Adopting a disciplined investment approach based on sound principles and maintaining a long-term perspective can help mitigate the impact of market fluctuations on your portfolio.

- Furthermore, periodically rebalancing your portfolio to maintain your target asset allocation can help control risk and ensure that your investments remain aligned with your financial objectives. Rebalancing involves selling assets that have appreciated in value and reallocating the proceeds to underperforming assets, restoring the desired asset mix.

- Investment Vehicles for Safe Investing

- Several investment vehicles are well-suited for investors seeking safety and stability:

- Stocks: While stocks offer the potential for high returns, they also carry higher volatility and risk compared to other asset classes. Investing in large-cap, blue-chip companies with a history of stable earnings and dividends can provide exposure to equities while mitigating downside risk.

- Bonds: Bonds are debt securities issued by governments, municipalities, or corporations, offering fixed interest payments and return of principal at maturity. Investing in high-quality bonds, such as U.S. Treasury bonds or investment-grade corporate bonds, can provide steady income and capital preservation.

- Real Estate: Real estate investments, including residential and commercial properties, can provide diversification and income through rental yields. Real estate investment trusts (REITs) offer a convenient way to invest in real estate without the hassle of property management, providing liquidity and income potential.

- Cash and Cash Equivalents: Cash and cash equivalents, such as savings accounts, money market funds, and certificates of deposit (CDs), offer stability and liquidity, making them suitable for short-term cash needs and emergency funds.

- Alternative Investments: Alternative investments, such as commodities, precious metals, and hedge funds, can provide diversification and downside protection in volatile markets. However, they often carry higher fees and less liquidity than traditional investments.

- Due Diligence and Research

- Conducting thorough due diligence and research is essential when selecting investments for your portfolio. Before committing capital to any investment, take the time to understand the underlying fundamentals, risks, and potential returns. Consider factors such as the company’s financial health, competitive positioning, management team, and industry dynamics.

- Additionally, diversify your research sources and seek advice from reputable financial professionals, such as certified financial planners (CFPs) or registered investment advisors (RIAs). Beware of investment scams and fraudulent schemes promising unrealistic returns, and always prioritize capital preservation and risk management.

- Conclusion

Introduction

Safe investing is a cornerstone of financial planning, offering opportunities for wealth accumulation and long-term growth. However, the world of investing is not without its risks. Market volatility, economic downturns, and unforeseen events can pose significant threats to investment portfolios. In this article, we will explore strategies and principles for investing safely, helping you navigate the complexities of the financial markets with confidence and prudence.

Understanding Risk and Return

Before delving into specific investment strategies, it’s crucial to grasp the fundamental relationship between risk and return. In general, higher returns are associated with higher levels of risk. Conversely, investments offering lower returns tend to be less risky. Understanding your risk tolerance and investment objectives is key to constructing a portfolio that aligns with your financial goals and comfort level.

Diversification: The Foundation of Safe Investing

Diversification is a cornerstone of prudent investing and serves as a powerful risk management tool. By spreading your investments across a variety of asset classes, sectors, and geographical regions, you can reduce the impact of individual market fluctuations on your portfolio and help with safe investin. A well-diversified portfolio may include a mix of stocks, bonds, real estate, and alternative investments, providing exposure to different sources of return while mitigating overall risk.

Asset Allocation: Finding the Right Balance

Asset allocation refers to the strategic distribution of your investment capital across various asset classes based on your risk tolerance, investment horizon, and financial goals. A balanced asset allocation strategy aims to optimize risk-adjusted returns by allocating assets according to their expected risk and return characteristics. Factors to consider when determining asset allocation include age, income, time horizon, and liquidity needs.

For example, younger investors with a longer time horizon may tilt their portfolios towards equities, which historically offer higher returns over the long term despite greater short-term volatility. On the other hand, older investors approaching retirement may prioritize capital preservation and income generation, leading to a more conservative allocation with a higher proportion of fixed-income investments.

Risk Management: Setting Realistic Expectations

Effective risk management is essential for safeguarding your investments against unforeseen market events and downturns. While it’s natural to seek high returns, it’s equally important to temper expectations and avoid taking excessive risks in pursuit of quick gains. Adopting a disciplined investment approach based on sound principles and maintaining a long-term perspective can help mitigate the impact of market fluctuations on your portfolio.

Furthermore, periodically rebalancing your portfolio to maintain your target asset allocation can help control risk and ensure that your investments remain aligned with your financial objectives. Rebalancing involves selling assets that have appreciated in value and reallocating the proceeds to underperforming assets, restoring the desired asset mix.

Investment Vehicles for Safe Investing

Several investment vehicles are well-suited for investors seeking safety and stability:

-

Stocks: While stocks offer the potential for high returns, they also carry higher volatility and risk compared to other asset classes. Investing in large-cap, blue-chip companies with a history of stable earnings and dividends can provide exposure to equities while mitigating downside risk.

-

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations, offering fixed interest payments and return of principal at maturity. Investing in high-quality bonds, such as U.S. Treasury bonds or investment-grade corporate bonds, can provide steady income and capital preservation.

-

Real Estate: Real estate investments, including residential and commercial properties, can provide diversification and income through rental yields. Real estate investment trusts (REITs) offer a convenient way to invest in real estate without the hassle of property management, providing liquidity and income potential.

-

Cash and Cash Equivalents: Cash and cash equivalents, such as savings accounts, money market funds, and certificates of deposit (CDs), offer stability and liquidity, making them suitable for short-term cash needs and emergency funds.

-

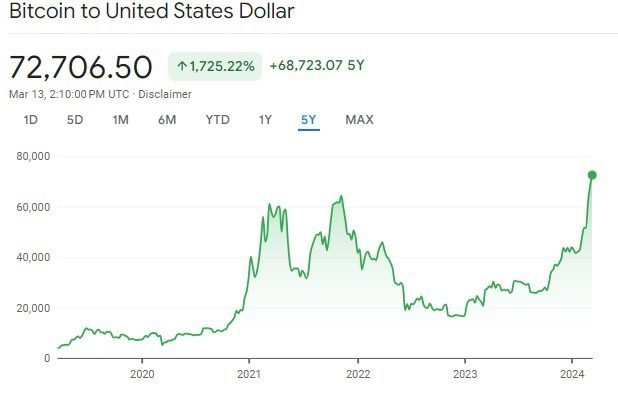

Alternative Investments: Alternative investments, such as commodities, precious metals, and hedge funds, can provide diversification and downside protection in volatile markets. However, they often carry higher fees and less liquidity than traditional investments.

Due Diligence and Research

Conducting thorough due diligence and research is essential when selecting investments for your portfolio. Before committing capital to any investment, take the time to understand the underlying fundamentals, risks, and potential returns. Consider factors such as the company’s financial health, competitive positioning, management team, and industry dynamics.

Additionally, diversify your research sources and seek advice from reputable financial professionals, such as certified financial planners (CFPs) or registered investment advisors (RIAs). Beware of investment scams and fraudulent schemes promising unrealistic returns, and always prioritize capital preservation and risk management.

Conclusion

Investing safely requires a combination of discipline, diversification, and risk management. By understanding your risk tolerance, establishing a well-diversified portfolio, and conducting thorough due diligence, you can mitigate the inherent risks of investing and position yourself for long-term success. Remember to maintain a long-term perspective, stay informed about market developments, and seek professional guidance when needed. With prudent planning and careful execution, you can safeguard your investments and achieve your financial goals with confidence.

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua